When Success Attracts Entitlement: The Richest in the Room

Disclaimer . This story is shared as a lived experience — sometimes mine, sometimes inspired by real conversations and moments I’ve witnessed or been trusted with. Details may be adjusted to protect privacy, but the lessons remain real. This is not professional financial, legal, or tax advice. It’s simply a reflection, an experience, and an invitation to think differently about money, choices, and life. What worked (or didn’t) in one situation may not work the same way in another. Take what resonates, leave what doesn’t, and apply what feels aligned with your own circumstances, values, and goals.

This discussion did not start with celebrities.

It started with real life — in my article My Money, My Aunty, My Friend, where I explored how money requests from people we love can quietly damage relationships, trust, and emotional safety.

What followed was a deeper realization:

this issue is not about amounts.

It is about entitlement to someone else’s success.

Whether you are a global athlete or simply earning more than the people around you, the pattern is the same.

The High-Paid Perspective: When Success Stops Belonging to You

At the highest level, financial entitlement is visible — and publicly documented.

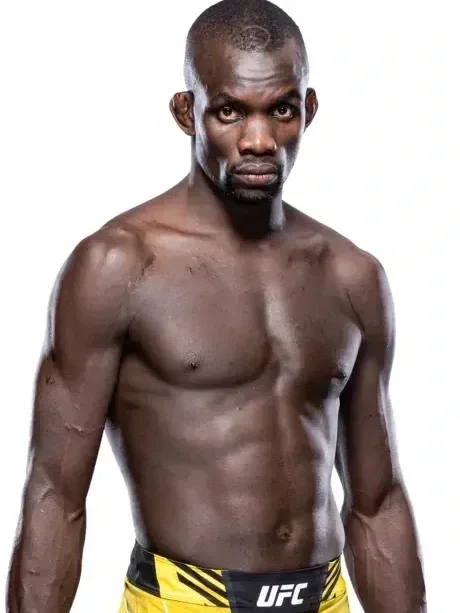

Themba Gorimbo (UFC) — CNN African Voices

Zimbabwean UFC fighter Themba Gorimbo, in an interview with CNN’s Larry Madowo on African Voices, spoke with striking honesty about why he cut ties with his family.

“My family feels entitled… they feel like my success is their success. That’s the word — entitlement.”

He went further:

“I love my family from far. If I keep talking to my family members, I will not achieve my goal.”

And on financial pressure:

“We are blackmailed that we cannot say no. The black tax is real. We cannot say no to somebody asking for money.”

Despite becoming the first Zimbabwean to win a UFC fight in 2023, success did not bring relief — it brought expectations.

“Nobody in Zimbabwe supported me. Including my own family. I had this dream by myself.”

This is a powerful example of how family pressure becomes part of your financial ecosystem, whether you choose it or not.

→ Understanding Your Financial Ecosystem

When Entitlement Turns Public: The GloRilla Example

This pressure is not limited to athletes like Themba Gorimbo. It is now unfolding publicly with rapper GloRilla.

The Memphis-born artist has recently been at the center of online backlash after a family member accused her of not providing enough financial support. The claims focus on everyday needs — rent gaps, small loans, basic expenses — but the underlying message is familiar: because she succeeded, she is expected to carry everyone else.

What makes this especially telling is GloRilla’s background. She has been open about growing up in extreme poverty with nine siblings — sleeping on air mattresses, in church pews, and living in a hotel with her father. Through music alone, she built a career that lifted her out of those conditions.

Yet once success arrived, the narrative shifted.

One person made it — so everyone should benefit.

The details may differ, but the pattern is the same: success becomes communal property, boundaries are questioned, and private family dynamics turn into public entitlement.

Tony Parker — Podcast Fracture (France)

Former NBA champion Tony Parker shared a similar reality on the podcast Fracture.

“Quand l’argent arrive, certains pensent que tout est normal.

Donner 10 000 €, prendre un avion privé, comme si c’était un dû.”

(Translation: When money arrives, some people think everything is normal. Giving €10,000, taking a private jet — as if it’s owed.)

Parker explains why he learned to say no and why he stayed grounded early in his career — to build a base before giving.

Not because he lacked generosity.

But because unstructured giving destroys foundations.

This is exactly why budgeting with purpose is not about restriction — it is about protection.

→ Budgeting with Purpose

What These Stories Reveal

Despite different careers, the message is identical:

Success becomes collective

Boundaries become negotiable

Money becomes accessible by default

And here is the misunderstanding that causes the most damage:

Earning money does not mean you have money.

You still pay:

taxes

rent or a mortgage

bills

long-term investments

future planning

Higher income does not erase reality.

It increases responsibility.

This distinction is essential when learning how to prepare your budget for the next year — especially when external pressure exists.

→ How to Prepare Your Budget for the Next Year: A Purpose-Driven and Practical Guide

The Everyday Reality: “You’re the Rich One Here”

Now remove fame.

You do not need to be a UFC fighter or an NBA champion to experience this.

In many families, pressure falls on:

the person earning in euros or dollars

the one living abroad

the one with a stable job

the one earning more than the room

Suddenly, you are the rich one.

Not because you are wealthy —

but because someone else earns less.

This is where entitlement quietly starts shaping your money decisions — often without your awareness.

Earning Money Does Not Mean You Have Money

Your income is not your savings.

Your salary is not your availability.

Your earnings are not your freedom.

When you give under pressure:

You try to build.

You get delayed.

You get financially pulled backward.

This is why learning the best way to budget and how to budget with purpose matters — especially when others feel entitled to your income.

→ The Best Way to Budget: 5 Budgeting Methods and How to Budget With Purpose

More Income, More Entitlement — Not More Education

A common belief is:

“If I give them access to my money, they will understand money.”

Access does not create education.

It does not teach:

planning

boundaries

sustainability

Instead, it can reinforce dependency.

Money decisions do not exist in isolation — they are shaped by people, pressure, and expectations.

→ Understanding Your Financial Ecosystem

When the Same Pressure Exists at a Lower Salary

Entitlement does not disappear at lower income levels.

It becomes more dangerous.

You may still be perceived as rich — simply because you earn more than others — while your margin for error is smaller.

This is how financial pressure turns into emotional strain, and why money conversations are often hardest with people we love.

→ Pillow “Money” Talk — Honest Financial Conversations in Relationships

The Mental Health Cost of Financial Accessibility

Constant financial expectation can lead to:

anxiety around money

guilt when saying no

stress before family interactions

burnout disguised as generosity

When money pressure intersects with emotional bonds, the cost is rarely visible — but deeply felt.

This is often where love, loyalty, and finances collide.

→ Crazy in Love — When Love Ends and Money Begins

Why Budgeting With Purpose Is About Protection

Budgeting with Purpose is not just about tracking expenses.

It is about:

protecting your future

identifying silent financial drains

understanding emotional pressure

building boundaries that last

Budgeting is not about saying no to others.

It is about saying yes to sustainability.

→ Budgeting with Purpose

Final Thought

Success is not the absence of limits.

Income is not an obligation.

Generosity should never cost you your health.

Whether you are a public figure or the highest earner in the room:

You are allowed to build without being drained.

You are allowed to earn without being owned.

You are allowed to say no without explaining your entire life.

That is not selfishness.

That is budgeting with purpose.

Start Budgeting With Purpose — Free Tools Available Now

Budgeting with Purpose is about more than tracking expenses. It helps you understand your financial reality, identify blind spots, and build long-term clarity.

Two free tools are now available to help you get started:

Free Budget Tracker

The AfroBudgetinGirl Budget Tracker helps you see your money clearly, plan monthly or yearly, track irregular expenses, and prioritise actions using the Action Priority Matrix.

200 Questions Workbook Extract (Free)

Some financial risks don’t appear in spreadsheets. This workbook extract helps you uncover blind spots, understand what’s driving your decisions, and map those insights into numbers using your budget.

👉Free download : Budget Tracker and Workbook Extract

The Money Design Session (Coming Together)

These tools introduce the Money Design Session — a practical way to map your financial ecosystem, identify patterns, and strengthen your foundation with intention.

Here’s what to do:

List every part of your financial environment — from family and work to culture and media.

Analyse how each one influences your mindset, habits, and goals.

Identify patterns and blind spots.

Strengthen your foundation by aligning your money with your true objectives.

This is how budgeting becomes a tool for direction — not restriction.

Want Early Access?

The Budgeting with Purpose Masterclass is in development.

👉 Subscribe to receive:

practical guidance to live intentionally — financially and personally

I’m AfroBudgetinGirl, and this is my Diary — where every story matters because your story matters.

Through real experiences and true lessons, I help you question, plan, and protect your financial journey.

Financial literacy isn’t just about numbers — it’s about boundaries, courage, and self-respect.

So next time someone says, “Can you help me out?”, ask yourself: Will this help them — or hurt me?